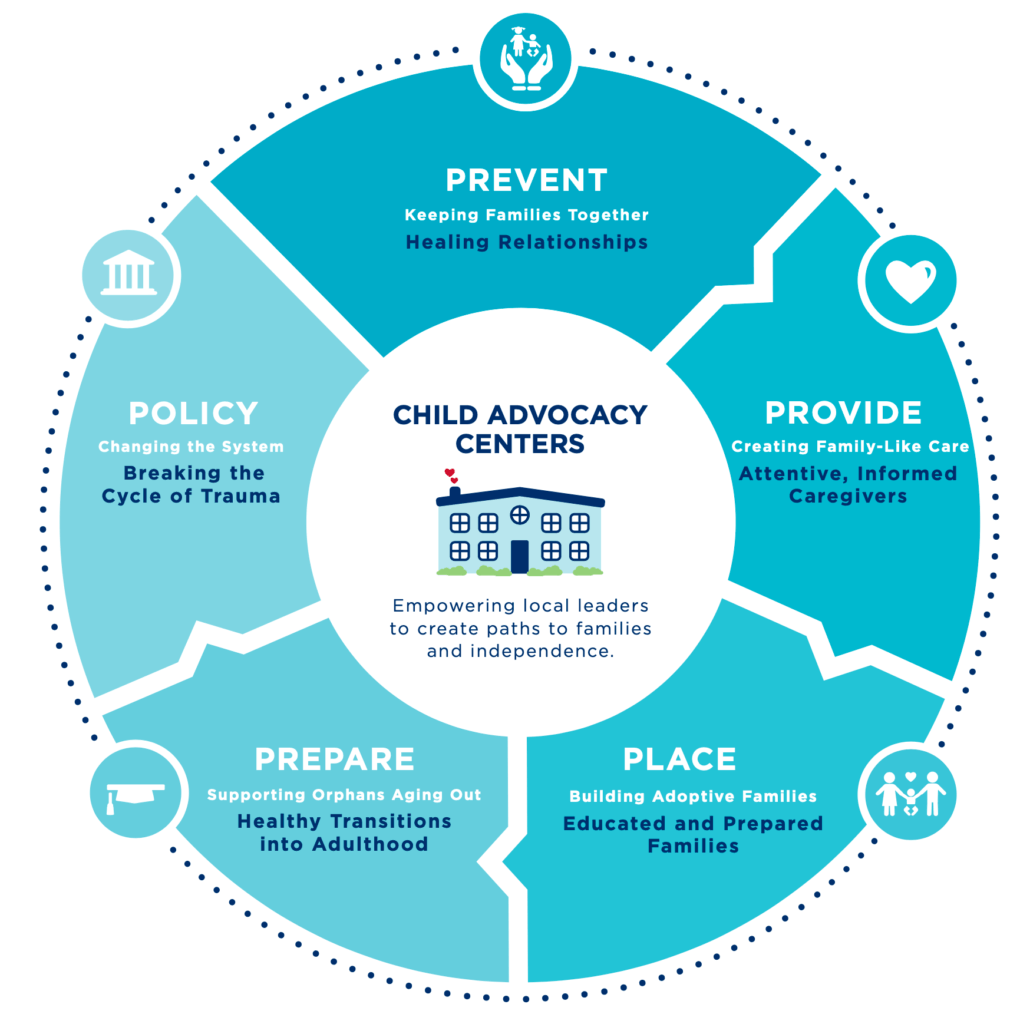

How We Work

Our initiatives work together to create lasting change for the millions of children living in institutions, and open up more paths to family and independence.

How We're Intervening

Prevent

Education Sponsorship

Prevention in action

Provide

Trauma-Informed Care

Providing in action

Place

International Adoption Programs

We believe that every child deserves the love of a family. Through our adoption programs around the world, we’re helping more children unite with their loving forever families. AGCI is committed to finding families for children, not children for families, and our team of experienced, passionate adoption advisers is here to walk every step of this journey with you. AGCI currently has international adoption programs in Bulgaria, Burundi, China, Colombia, Costa Rica, Ecuador, Haiti, the Philippines, and South Africa.

Placing in action

While the McAndrews had always planned on growing their family through adoption, they thought they would adopt one child—not three siblings! READ MORE

Prepare

A Path and a Plan

Preparing in action

Angela is one of the first young women in our Dream Home to graduate! Angela recently earned her degree in accounting and is now working full-time. We are so proud of her and all that she has accomplished.

Policy

Empowering Leaders

Through Child Advocacy Centers that act as a regional hub, we can partner with and empower local leaders to serve as advocates and change the system. By recruiting, training, and lifting up leaders, together, we can influence governmental policy, implement nationwide social service programs and trainings, lead sponsorship programs, and coordinate advocacy teams in country.

Policy in action

“We had an opportunity in February to learn about TBRI®. It’s something that just lit up our minds and hearts. Comparing TBRI® to our Child Welfare system in Colombia makes us realize that we need to do more. The way that we have been attending to kids wasn’t actually what the children needed. From there, a seed was planted. We have received so much support from All God’s Children International and we have started to grow a movement around TBRI®.”

–Andrea Leon, Director of Adoption, Colombia